As China goes through rapid urbanisation, its energy demands are evolving with it. Here we look at some of the key drivers of the new energy landscape in China and how Smart Energy will have a significant role in managing energy efficiency and the country’s clean energy transition.

Smart Energy and urbanisation in China

The concept of Smart Energy is a shift away from single-sector efforts towards a system-oriented, cross-sectoral approach to transform the energy landscape and create solutions for a more sustainable future. This concept brings together different sectors – including electricity, gas, building, industry and transportation – to work in synergy towards sustainable energy usage and management.

The need for a Smart Energy system is driven by China’s urbanisation. At the end of 2018, 59.6% of China’s total population lived in urban areas, which was far behind more developed countries such as the United States and South Korea where the urbanisation rate is currently around 80%.

Urbanisation has always been a challenge for the Chinese government. According to government reports, the annual average growth rate of urbanisation will remain around 1 percentage point. With such a large population, this means approximately 14 million people will move to urban areas each year. Annual average growth in China’s energy consumption is similarly expected to grow by 1.1% year on year. China is the world’s largest energy consumer and projected to account for 22% of world energy consumption by 2040 [1]. In addition to urbanisation, another contributing factor that will increase energy consumption is the expected increase in vehicle ownership. In 2019, only 33% of households in China [2] owned at least one vehicle, compared to 93.3% in the US.

Key trends shaping the energy industry

Innovation, technology transformation and resilience are promoting the development of the energy industry. Here are seven key trends that will shape the energy industry.

- Improved energy storage and battery systems will facilitate the transition from fossil fuel dependence and disrupt energy consumption patterns.

- Renewable energy will take center stage. Many governments around the world are increasingly pushing for decarbonisation and establishing an energy mix which includes renewables. Furthermore, companies such as Google, Amazon, Apple and Walmart are investing in renewable energy projects, like solar and wind farms, intensifying the competition in this space.

- Distributed Energy Resource (DER) systems, which are small-scale power generation or storage technologies that typically range from 1 to 10,000 kW, are gaining popularity especially among consumers who are looking to save money, use cleaner energy sources, ensure resilience and gain more control over their energy use.

- Digitisation will fuel the development of sharing economies. Artificial intelligence (AI), blockchain networks and IoT will revolutionise the energy industry.

- The smart home market is expected to grow. New smart home technology, like smart speakers, are putting ‘power’ back in the hands of consumers, providing the option to monitor real-time energy consumption and manage energy costs with a single-switching system between connected home devices [3].

- In China, energy strategies and policies have great influence on the country’s energy industry. The “double control” strategy of managing total energy consumption and energy intensity will mitigate global climate change and the restriction of domestic resources for rapid economic development. It will continue to shape the future of China’s energy market.

- New technologies have given rise to new physical and cybersecurity risks. The proliferation of decentralised and interconnected Smart Energy assets creates greater vulnerability to malevolent security breaches. Industry and government must step up security efforts to protect against cyber threats.

Investment opportunities in the time of a pandemic

Globally, energy investment is set to fall by one-fifth in 2020 because of the Covid-19 pandemic [4]. While China remains the largest market for investment and a major determinant of global trends, the estimated 12% decline in energy spending in 2020 is softened by the relatively early restart of industrial activity following strong lockdown measures in the first quarter [5]. It is suggested then that renewable power, electricity networks and energy efficiency are investment sectors with profit potential. For example, the construction of ultra-high voltage (UHV) electricity lines (network) is currently being encouraged by Beijing.

In the case of improving energy efficiency, optimising energy structure (the energy source mix) will be key. To achieve the goal of total coal consumption control and reducing air pollution, the National Development and Reform Commission (NDRC) issued the Interim Measures for the Substitution and Management of Coal Consumption Reduction in Key Areas in 2014 (FGHZ [2014], No. 2984) [6]. Coal consumption reduction actions have been practised in Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang and Guangdong’s Pearl River Delta Region, requiring all these provinces and areas to propose specific measures for coal consumption reduction and quantities to be reduced. Those areas are priority investment regions.

Sector growth and national policy

China’s energy industry is deeply affected by national strategies and policies. The national energy strategy of China has been shifting amid the geopolitical and global market changes that define 2020 — including the trade war and coronavirus outbreak.

In June, the country’s energy regulator, National Energy Administration (NEA), released the belated annual national energy strategy, Energy Sector Work Guiding Opinions for 2020. The key conclusions include:

- Major Strategy Change 2020: “Energy Security” Back to No. 1

- Power Market Reality: Limited Growth Space

- A Renewables Strategy: From “Stable” Growth to “Maintaining” the Growth

- Storage: Renewables-oriented Demands

- Hydrogen: A New Sector Rising in China’s Energy Strategy and Mix

- Clean Heating: From Natural Gas to Renewables

What Smart Energy will look like in 2030

It is projected that US$ 64 billion will be invested in Smart Energy technologies by 2030. The one constant in all energy forecasts is the ambition of continued carbon reduction. Now, let’s imagine what 2030 could look like.

Technology – creating a new low-carbon world: Smart Energy communities are combining renewable energy generation, energy storage, smart meters, green buildings, blockchain, IoT, AI and other technologies to exert more control over their energy usage. Energy storage is crucial in balancing energy supply and demand. Batteries underpin an industrialised electric vehicle market in which China leads manufacturing and dominates the supply chain.

A fully renewable energy future: In the next 10 years, solar power is expected to become cheaper than fossil fuel energy. By 2050, analysts forecast that it would be possible for all sectors to run solely on renewable energy [7]. It is notable that green hydrogen is emerging as a potentially viable energy resource and will threaten the fossil fuel stronghold on energy-intensive industries, including steel and cement.

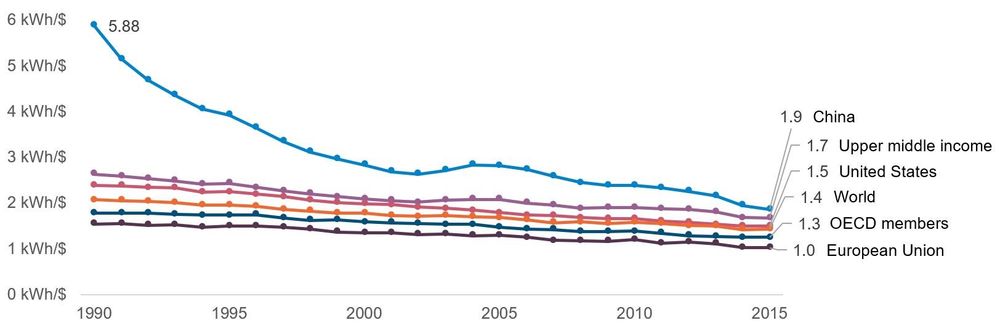

Achieving 3E (Energy, Economy and Environment) standards with energy efficiency: Cities in China, California, Japan and Europe are leading decarbonisation, modelling how we consume energy efficiently. One goal of Smart Energy is to achieve economic growth with as little energy input as possible.

At the global level, there has been a distinct downward trend in the energy intensity of economies. High-income economies typically have the lowest energy intensity. In 1990, China used 5.88 kWh of energy to produce one US dollar of economic output (measured at purchasing power parity). In 2015 this had decreased to 1.86 kWh – a 68% reduction. However, the level of China’s energy intensity is still higher than the global average. The energy intensity level of China was nearly double that of the European Union in 2015.

Energy management technologies are regarded as the cheapest and most immediate way to help accomplish intensity reduction goals. Hence, China’s energy efficiency industry is emerging as a high growth sector because of the country’s policies, including its “double control” strategy. Firms that develop cost-effective, energy-saving technologies, such as Energy Management Systems (EMS), are poised to capture opportunities in this space. Investors should pay more attention to EMS enterprises with profit potential.

Greater collaboration among key stakeholders: The biggest barrier to the quick deployment of Smart Energy systems is complex stakeholder management. Conflicting demands exist among residents, government bodies, energy providers, grid operators, regulators and real estate developers. Open and transparent communication and engagement between stakeholders and communities are key to the successful implementation of Smart Energy projects.

References

- [1] & [4] International Energy Agency: Total Global Energy Investment, 2017-2020

- [2]University of China Academy of Social Sciences: China Economic Blue Paper 2020

- [3] Markets and Markets: Smart Home Industry Worth $163.7 Billion by 2028

- [5] International Energy Agency: World Energy Investment 2020

- [6] E3S Web of Conferences: Policies and Standards for “Double Control” of Total Energy Consumption and Energy Intensity

- [7] Smart Energy Transformation Asia, 2019